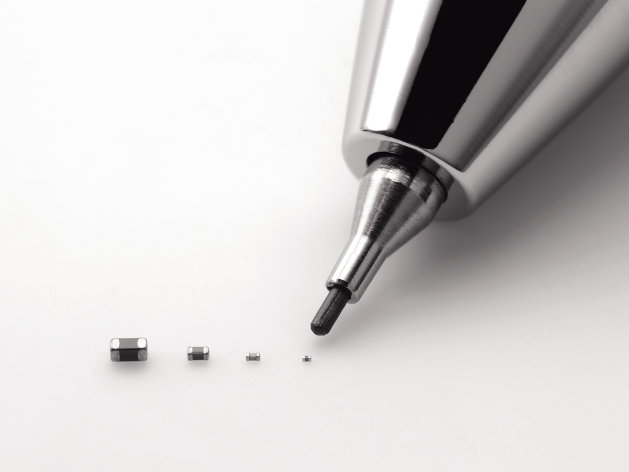

Murata Manufacturing Co. - In this undated photo released by Murata Manufacturing Co., its latest capacitor, measuring just 0.25 millimeter by 0.125 millimeter, right, is pointed by a mechanical

TOKYO (AP) — Small is big for Murata: The Japanese electronics maker has developed the world's tiniest version of a component known as the capacitor. And that's potentially big business.

Capacitors, which store electric energy, are used in the dozens, even in the hundreds, in just about every type of gadget — smartphones, laptops, parts for hybrid cars, medical equipment and digital cameras. Smaller componentry allows for other innovations and improvements from thinner devices to longer battery life.

The latest capacitor, measuring just 0.25 millimeter by 0.125 millimeter, is as tiny as the period at the end of this sentence.

Murata Manufacturing Co.'s focus on highly specialized technological breakthroughs, such as the one announced Wednesday, also underlines the challenges confronting Japan's electronics industry — once unquestioned leaders but now taking a beating from cheaper Asian rivals.

Japanese makers have struggled to compete against South Korean rivals and manufacturers in Taiwan, China and the rest of Asia with access to cheaper labor. The Japanese are also fighting the strong yen, which erodes the value of its earnings.

"The power of Japanese high-tech makers is waning — in development, marketing and management. And it can't all be blamed on a strong yen," said Rick Oyama, analyst with market researcher HIS iSuppli in Tokyo. "What counts is whether a company can deliver creative products and innovation."

Murata, based in the ancient capital of Kyoto, central Japan, is best known for its bicycle-riding robot, which showcases its delicate sensor technology. But since its founding in 1944, the company's core business has been ceramic capacitors.

The latest super-small capacitor is a quarter of the size of the previous smallest ceramic capacitor, also developed by Murata, in 2004.

Murata Executive Vice President Yukio Hamaji, who heads the component business, said that building something so small that is composed of even tinier layers of material to store electricity, is a challenge, requiring precision in preparing raw materials and baking the ceramic.

"This is so small you can barely see it," he told The Associated Press. "You can imagine how difficult making something that small can be, and do it in mass production and in stable supply."

Murata is the world No. 1 in market share and production capacity in ceramic capacitors.

It controls about 35 percent of that market, trailed by Samsung Electro-Mechanics Co., which is the component unit of South Korea's Samsung, with about 20 percent of the market.

Hamaji acknowledged that Samsung, close on Murata's heels in super-small capacitors, was a threat, and stressed that Murata was learning from Samsung the importance of being nimble.

Japanese electronics makers have been struggling lately.

Sony Corp. posted its biggest loss in its 66-year history for the fiscal year ended in March. It was Sony's fourth straight year of red ink and highlighted its fall from the days when it wowed consumers with its Walkman portable music player and reigned supreme in color TVs.

Sony's archrival Panasonic Corp. hasn't fared any better, racking up an even bigger loss than Sony for the fiscal year ended in March, also the worst in its 94-year history, and among the biggest annual losses ever for Japanese manufacturers.

In even worst shape is Sharp Corp., which is trying to woo investment from Taiwan's Hon Hai Precision Industry Co., but it has yet to announce a final deal as Sharp shares nose-dived, making its prospects shakier than ever.

Other Japanese electronics makers, such as Toshiba Corp. and Hitachi Ltd. are focusing on high-speed trains and nuclear power plants, rather than consumer electronics and computer chips as the Japanese did in decades past.

One of the key failings of the Japanese in consumer products, such as cellphones, was the inability to foresee and adapt to changes in the global market.

Although the "i-mode" cell-phone service NTT DoCoMo pioneered in 1999 for text messaging and network information was way ahead of its time, it proved too insular, and grew obsolete, as the iPhone as well as handsets using Android technology from Google arrived.

Murata still has an edge. Murata, which employs 37,000 people, rakes in nearly 90 percent of its nearly 585 billion yen ($7.5 billion) annual sales from abroad.

But even the latest capacitor is not going to be making millions for Murata just yet. It is still so new products have yet to be designed that use it. But Hamaji stressed it was crucial for Murata to keep innovating, and show the world it was going to stay No. 1 and was getting only better.

"Murata has to be that place where everyone goes for a capacitor," he said.

___

No comments:

Post a Comment